But when it comes to planning your next excursion, chances are you contacted travel insurance as a means for protecting the investment in your trip and giving yourself peace of mind. However, if you ever heard of desti-specific travel insurance\GeneratedValue This individualized coverage provides potentially broader protection depending on the specific risks and needs of your preferred destination. This post highlights the advantages of destination-specific travel insurance and how it can improve your journey on this particular trip.

Understanding Destination-Specific Travel Insurance

Destination-specific travel insurance is a unique type of coverage meant to protect from the specific issues or risks one might face when traveling within an individual country/region. Tailored plans, on the other hand, may incorporate elements that are not covered by standard travel insurance policies including:

Healthcare System and ExpensesLocalizedMessage

Political stability

Natural disaster risks

Best adventure activities in the region

Local laws and regulations

When an insurer knows more about you it can offer a plan that better reflects your needs, which could save you money as well as make sure that you are covered in the best possible way.

Key Benefits of Destination-Specific Coverage

1. Customized Medical Coverage

Locations have different health risks and the cost of healthcare is in turn dependent. In the US, for example; medical treatment can be incredibly expensive and some countries around the world that are still developing may have limited healthcare facilities. Well, destination-specific insurance will take these factors into account and provide better statutory limits of cover, sometimes even a preferred provider network in the country you are traveling to.

2. Activity-Based Coverage

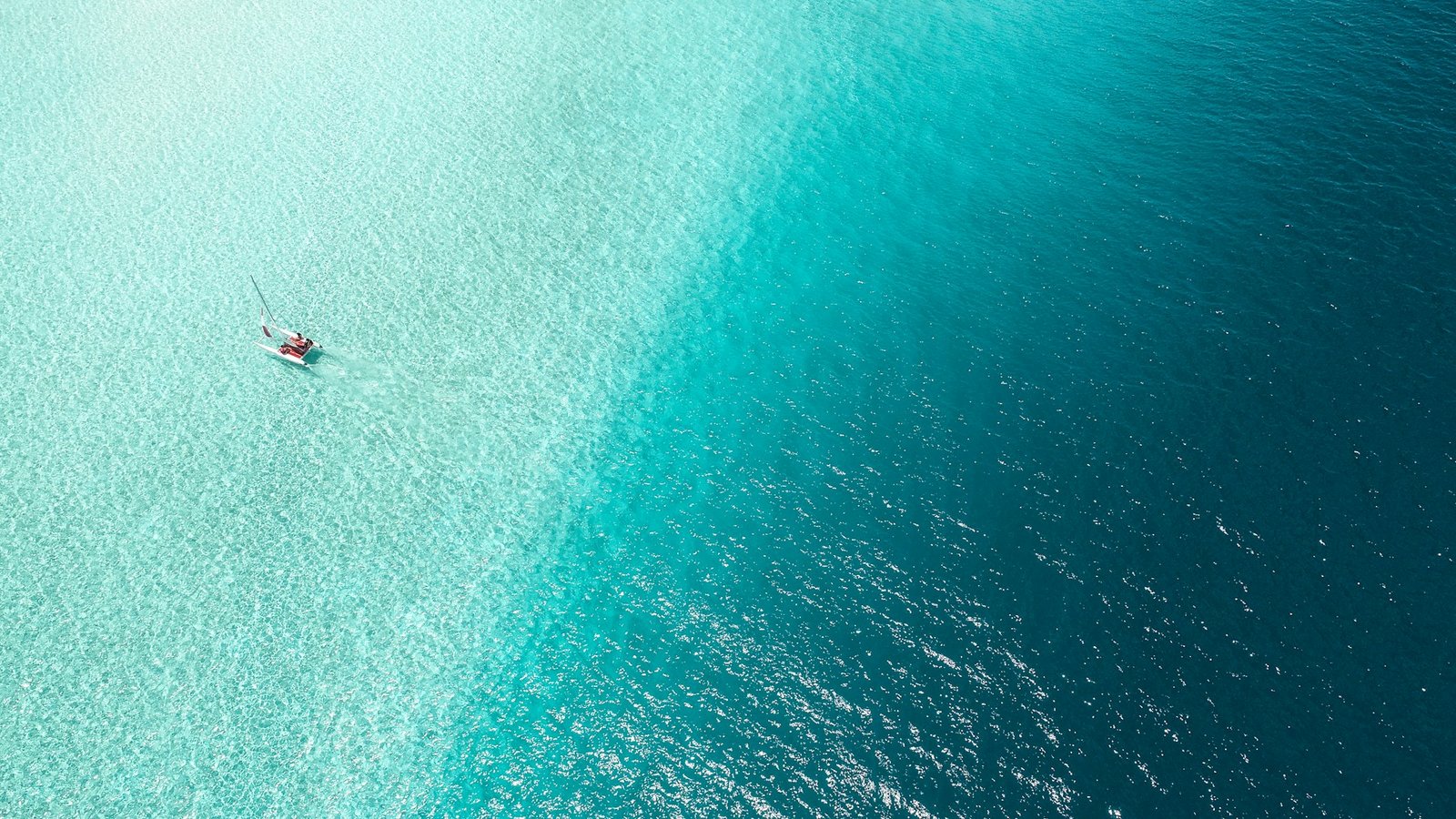

Some pilgrims take part in destination-specific activities, such as glaciers glissading by skis or snowshoeing the Alps sections to reach Mecca from dales within Asia and scuba plunge into wonderous locations of the West Australian coast around Exmouth along with North Coral-reef, trekking our mountain ranges inside Himalaya. These “high-risk” activities are commonly excluded from standard policies, but destination-specific coverage can add this to your policy so you stay protected on those adventures.

3. Natural Disaster Protection

Ocean pools are more beneficial in certain regions, and others; are prone to natural disasters such as hurricanes, earthquakes, or tsunamis. Local risks may also cause destination-specific policies to couple evacuation assistance and trip interruption benefits with the overview.

4. Political Instability Coverage

Destination Specific — For those traveling to areas of political unrest, policy options for destination-specific coverage such as evacuation due to political events or civil strife may be available but generally not included with basic policies.

5. Local Legal Assistance

Please note that some policies with a destination-specific aspect can also provide local legal support (which is crucial if you find yourself in any kind of trouble while abroad).

How to Choose the Right Destination-Specific Coverage

How to Pick Destination-specific Travel Insurance Step-by-Step

Read Up about Your Destination: Get familiar with the risks that come from heading to your potential destinations, keep in mind factors such as health & safety guidance whether any natural disasters are happening at those locations you would be staying, and finally, if it is a place which has been experiencing a form of political unrest.

The thing is it is easier to know that you are likely because the list of your activities in detail all events will sell his contention before, during, and after so much individual arisen.

Compare Policies: Review destination-based policies available from various insurance providers. Compare their offerings carefully, keeping in mind coverage limits and exclusions as well as any extra features that are particularly useful for the place you’ll be visiting.

Fine Print: Before doing any treatments elsewhere, always read the details of what is (soon to be not) covered Destination-specific clauses and benefits — Especially make sure you understand these.

Use Multi-Destination: If you are visiting multiple countries or regions in a single trip, try to find policies that include more flexible multi-destination coverage.

Check for Duplication: If you already have insurance (health, home, or through your credit card benefits) make sure there is no overlap in coverage to avoid paying twice.

Real-World Examples

For destination-specific travel insurance — Here we can take a few scenarios to explain the benefits of it.

Caribbean Cruise– a policy specific to this destination might offer extra coverage for hurricane-related cancellations or if you have an interruption; and as we mentioned above, also medical evacuation from remote islands.

African Safari: Coverage could range from trip delays due to airline strikes (which are prevalent in some African countries), medical evacuation from basic communities, and sports protection for things like hot air balloon rides.

Backpacking SE Asia – Policies with motorbike insurance (a popular mode of transport for tourists), food poisoning cover, budget accommodation theft protection

The Future of Travel Insurance

Traveling is becoming more and more varied, tailored to the individual’s travel story they have in mind — insurance providers must follow these developments. Destination-specific travel insurance As the first, entirely destination-based offering on offer from World Nomads it represents a move towards more custom-fit coverage. Or maybe in the future, policies that drill down even deeper — like coverage for each leg of a journey you take across the country.

Conclusion

While you might have to pay more for destination-specific travel insurance compared to standard policies, the added protection and peace of mind can be worth the price. It takes time and a bit of thinking about what makes your destination different, as well as your planned itinerary; Combine all those factors and get coverage that suits the nuances of an individual journey. Don’t forget travel insurance is there to enable you to go on your adventure and have peace of mind that if the worst does happen, you are covered. Start your next adventure with confidence and always be ready for the challenge of any destination with coverage that’s specific to wherever you choose to travel!